I have met with many qualified clients every week that all have one common problem, they don't know ho to save up all of the money need to purchase a home. These clients all have  decent jobs and pay rent, and they also know that once they are in a home they will easily be able to pay their monthly mortgage. The problem still exists: How will a first time buyer be able to save up the initial down payment?

decent jobs and pay rent, and they also know that once they are in a home they will easily be able to pay their monthly mortgage. The problem still exists: How will a first time buyer be able to save up the initial down payment?

I am happy to say that I have helped many families this year purchase home with little or no money down! So here is the question, "How do you do it?", "How is it possible to purchase a home with no money saved to put down?".

When you purchase a home, you need money for down payment and closing costs. Let's first discuss the "down payment". The amount of money you have to put down depends on the loan program you use. Let's assume in this scenario that you are buying a home as your primary residence (meaning that you intend to live there).

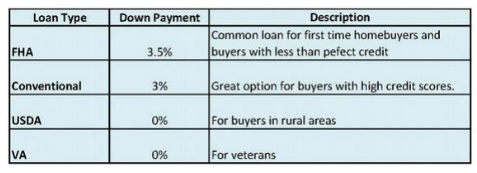

Let's now look at the different types of loans and the amount of money needed.

The easiest way to purchase a home is to use a USDA loan or VA loan. USDA loans are for purchases in rural areas (Stead, Cold Springs, Fernley, select areas in Spanish Springs) and feature $0 down options. VA loans are a benefit to veterans, and also are a $0 down option. However, if you are not a veteran or planning to purchase in a rural area, it is necessary to explore other options.

In the state of Nevada, we have an incredible opportunity for buyers with down payment grants. Grants for buyers are offered through the State of Nevada, and Nevada Rural Housing Authority. These grants are easy to qualify for and never have to be repaid. The grants offer down payment assistance in the range of 2-5%. If a buyer is using an FHA loan (which requires 3.5% down), and the buyer obtains a 4% grant from the state of Nevada, then the entire down payment amount is covered for the buyer by the grant!

The qualifications for Nevada grant programs are as follows:

- Minimum credit score of 640

- Qualifying income must be less than $95,500 per year

- Must be owner-occupied (buyer must live in the home)

-

Purchase price must be under $400,000

Now that I have shown you how to cover the down payment, we now need to look at closing costs. Closing costs include everything from inspections, appraisals, loan fees, and title and escrow fees, homeowner's insurance, property insurance, home warranty and so on. These costs can vary from one buyer to the other, but they are generally around 3% of the purchase price.

Closing costs cannot be financed into the loan; they must be paid up front, so this presents another hurdle. How can a buyer get their closing costs covered? Buyers have a few different options. Unlike your down payment which cannot come from the seller, closing costs can be paid by the buyer or seller, or even split between the buyer and seller.

The same grant programs used for down payment can also be used for covering closing costs. Over the years I have had VA buyers use a VA loan, and then use a grant program to purchase a home. In these cases, the buyer purchased with $0 down.

Homes can also be purchased with a seller's credit to the buyer. This means that in the original purchase contract, it can be negotiated that the seller pays the buyer's closing costs. For example, let's say that you are purchasing a home for $250,000. In this case, the closing costs will be approximately $7500. When writing the initial offer, a good buyer's agent can help negotiate a "seller's credit" for 3%. This means that at close of escrow, the seller will contribute $7500 towards the buyer's purchase.

One of our top buyer's agents is Joanne Tiernan at Montgomery Home Selling Team at Keller Williams Realty. She is a great negotiator and can help buyers through this process.

I hope I have shown you that there is a way to purchase a home with little to no money down. Homeownership is possible and the state of Nevada offers many great programs for buyers to take advantage of.

Interested in buying? Give me a call or fill our this online form to get started on your path to home ownership!

Leave A Comment